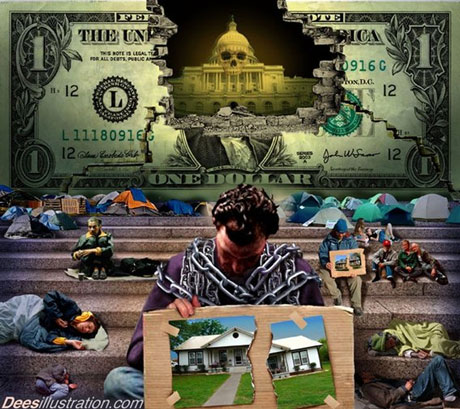

Could What Happen In The Argentina’s Financial Meltdown Happen Here?

Watch this video below on Argentina’s Financial Meltdown, then please share with your friends and family on social media and use the caption Argentina’s Financial Meltdown

In December 2001, the Argentinian government defaulted on $155 billion in public debt. Since then, this once-wealthy country has gone through five presidents and watched its currency fall by more than 70 percent. How do people survive in a broken economy?

The solutions range from the ingenious — barter clubs where members can exchange goods and services without money — to the brutal, including outbreaks of rioting.

Since un-hitching its peso from the U.S. dollar, Argentina has suffered a spectacular economic collapse. For market-wary Americans — shaken by the end of the bubble and economic turbulence — the questions arise:

Could Argentina’s dire economic situation ignite a new contagion that would sweep through Latin America, destabilizing the region, and further threaten America’s ill economy? And, beyond that, could something like that ever happen at home, undermining America’s middle-class stability?

With the most basic government services now only a memory and the army camped around the capital, how can the people of Argentina begin to put their society back together?

What does a financial meltdown look like? And where do American interests or responsibilities lie?

The real question we should be asking…. “When will this happen here in America?”

Watch the video below.

Ultimately, what brought this country to the brink of an implosion was runaway spending — amplified by corruption and the breakdown in the rule of law.

Can this happen in America? If you don’t think so…. ask yourself why? What make us an different than Argentina, Cypruss or the Roman Empire?

Discover How You Can Be Prepared and Prosper

Regardless Of The Any Economic Situation

Did You Know That all FIAT (PAPER) MONEY

Has A 100% Failure Rate?

The history of fiat money, to put it kindly, has been one huge major failure. In fact, EVERY fiat currency since the Romans first began the practice in the first century has ended in devaluation and eventual collapse, of not only the currency, but of the economy that housed the fiat currency as well.

Why would it be different here in the U.S.? Well, in actuality, it hasn’t been. In fact, in our short history, we’ve already had several failed attempts at using paper currency, and it is my opinion that today’s dollars are no different than the continentals issued during the Revolutionary War.

Fiat currencies have not been successful, and the only aspect of fiat currencies that have stood the test of time is the inability of political systems to prevent the devaluation and debasement of this toilet paper money by letting the printing presses run wild.

Sound familiar?

If there’s one thing that should be clear, it’s that nothing the government or their banking partners have done to solve the economic crisis has been for your benefit. They’ve enriched themselves, yet again, on the backs of the American people.

All the while, they’ve told us that everything is getting better. But anyone who’s paying attention know that nothing of the sort has happened. Printing our way out of debt is a sure indicator that our country is on the brink of a huge financial collapse.

“There’s fear and hysteria running through the entire global financial community, because as everybody knows all they did was postpone the inevitable.”

Make no mistake. It’s coming.

And when it hits, it’ll make the crisis of 2008 look like a picnic.